Given the very fact the Federal Reserve has drastically elevated the money provide, this will probably trigger the devaluation of the greenback, which may translate into run-off inflation. This is why Bitcoin — viewed as digital gold — is becoming a favourite among institutional traders as a hedge towards inflation. After all, such OTC brokerages specialize in securing giant amounts of crypto with out the buyer exerting a lot effort. As you may have doubtless surmised, OTC crypto transactions happen largely by way of brokerages or OTC desks. This service also goes by the name principal desk, derived from “principal risk”. Let’s say you are an investor with deep pockets looking to purchase giant quantities of BTC, just as Elon Musk asked Michael Saylor of MicroStrategy.

- To qualify for this tier, corporations must meet higher financial requirements, be present in their reporting, and undergo an annual qualification review.

- Bonds don’t trade on a formal change however banks market them via broker-dealer networks and they’re additionally thought-about OTC securities.

- Investors should go in with eyes open, ready to take accountability for thorough due diligence and prudent threat management.

- Unlike traditional stock exchanges, OTC buying and selling allows investors to commerce stocks directly with each other, with out the necessity for a centralized change.

- OTC markets are home to many up-and-coming companies across various industries.

After all, only high-volume trades, for principally institutional trades, would incur such excessive fees. Likewise, Huobi, Coinbase, Bithumb, and different crypto exchanges have their very own OTC desks reserved for high-volume purchasers. Instead, OTC drugs is the primary to come back to mind, as nonprescription drugs that still serve a medicinal objective however haven’t undergone stringent rules. OTC crypto is identical, trading in unlisted belongings because it was too pricey to adjust to a regulatory framework. IG International Limited is licensed to conduct funding enterprise and digital asset enterprise by the Bermuda Monetary Authority.

Our Services

The OTCQX doesn’t list the shares that sell for lower than 5 dollars, generally identified as penny shares, shell companies, or firms going by way of bankruptcy. The OTCQX contains solely 4% of all OTC stocks traded and requires the highest reporting requirements and strictest oversight by the SEC. Leveraged buying and selling in international foreign money or off-exchange merchandise on margin carries significant danger and will not be suitable for all investors. We advise you to rigorously consider whether or not buying and selling is suitable for you primarily based in your personal circumstances. We recommend that you just seek impartial recommendation and make sure you totally understand the dangers involved earlier than buying and selling. However, OTC buying and selling nonetheless involves risks, such as counterparty threat and potential regulatory concerns.

OTC markets commerce a spread of securities including stocks, bonds, derivatives, REITs, and ADRs. Many small companies, penny shares, shells and distressed corporations commerce on OTC markets due to more relaxed itemizing necessities. However, you can even discover extra established international companies and even some massive U.S. companies trading OTC. Pink sheet shares are considered especially dangerous, as they’re often penny shares that trade occasionally and could also be troublesome to precisely value.

Complete Guide To Otc Trading

Pricing, trade volumes, supply timelines—you can tweak as it suits you. This permits for extra flexibility and offers traders the prospect to buy stock at in any other case impossibly favorable terms. Although they proceed to provide market data via FINRA’s web site, in 2020, FINRA has filed a rule change with SEC. It proposes to stop its operation and it is wanting to be replaced by OTCQB.

This is a more conventional method where the broker doesn’t assume the market danger. Instead, they ask for a onerous and fast mediation charge for acquiring crypto belongings. From this historical graph of average BTC transaction fees, we see that OTC crypto trades have elevated in popularity over the last year.

Cons Of Otc Buying And Selling

However, this is actually not a plus for novices, who might not know where to look and how to analyze shares. Like the ever-expanding universe, there are all the time new fascinating stocks popping up within the huge area of economic markets. However, a few of these can’t be traded on well-liked exchanges just like the NYSE. OTC derivatives are contracts which are traded (and privately negotiated) instantly between two events without going by way of an trade or other middleman.

In an OTC market, dealers act as market-makers by quoting costs at which they may purchase and sell a safety, foreign money, or different economic merchandise. Bonds, stocks, as well as non-standard derivatives could be traded by traders on the over-the-counter (OTC) market. OTC trading provides firms that don’t meet stock exchange necessities the opportunity to raise capital, which might help fund enlargement and development.

This is a fertile floor for scammers who make up complete personalities and skilled experience to fool shoppers. To see if BTC OTC trading is for you, here is a transient overview of the benefits and flaws between exchanges and OTC channels. Before blockchain and cryptocurrencies existed, OTC trading has been an integral part of unofficial buying and selling, unmediated by giant establishments. Also, analyze their aggressive landscape to establish major competitors and see how they stack up. An innovative enterprise model in a growing business with few main rivals is good. Whether you’re a new investor looking to learn the ropes or an skilled one in search of new prospects, understanding the OTC markets is essential to a well-rounded portfolio.

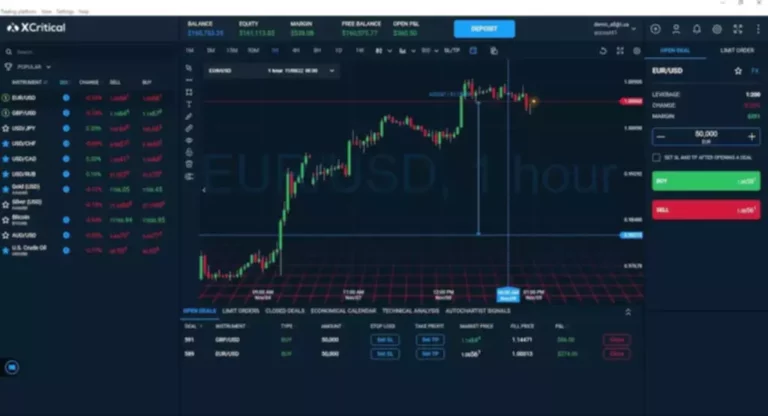

Forex Trading

These blanket statements make it simple to compartmentalize … but it’s necessary to be cautious. For any buying and selling strategy, it’s necessary to have good threat management. These days, along with offering citation companies, OTC Markets provides data.

Pink sheets corporations are non-public corporations that work with broker-dealers to get small firm shares to the buying and selling market. It entails smaller transactional costs, but the risk is high as they’re prime targets for market manipulation. These shares don’t meet Securities and Exchange Commission (SEC) necessities and subsequently needn’t file their financials with them. It’s important to remember that whereas OTC stocks can present massive alternatives for positive aspects, in addition they come with dangers.

An over-the-counter market can consist of any security, similar to equities, commodities, and derivatives. One of the primary disadvantages of OTC trading is the lack what is otc trading of transparency. Unlike trading on a centralized change, where all transactions are recorded and publicly out there, OTC trades are sometimes conducted privately.

The OTC Markets Group supplies worth transparency by publishing the most effective bid and ask costs from market makers on their website and trading platforms. They don’t truly match patrons and sellers or facilitate trades. In easy phrases, the trade value is set by the investor and the dealer-broker community.

What’s An Otc Stock?

If you wind up holding the bag on a few of these OTCs, you can be holding the bag for all times. I know it’s a slight nuance, nevertheless it makes a distinction in how the securities trade. In 1999, it became the first firm to convey digital quotation companies to the OTC markets. It’s modified its name a few instances because it formed — it was originally the National Quotation Bureau — but it’s at all times labored in OTC buying and selling. A broker-dealer community is a gaggle of broker-dealers working collectively. Only if they’ve exhausted different payment means and might absorb the supply delays, contract negotiation challenges, and product high quality issues.

Typically, OTC markets are considered fairly risky and unpredictable. The lack of regulations can lead to market manipulation, and the worth of a security is essentially left to the discretion of market managers. Therefore, efficient danger management strategies are really helpful for buyers to reduce the probabilities of a loss. In the OTC markets, buying and selling securities can lead to a massive liquidity crunch.

OTC markets also trade equities of simply not small firms, however some well-known large corporations too. For a lengthy time, firms like Blackberry (BS) and Ford have traded as pink sheet shares. One of the prevalent stocks traded on OTC markets is American depository receipts (ADRs). These shares largely represent shares in companies that commerce on overseas exchange.